I went and did it. Instead of prudently investing the last instalment of my current year’s pension allowance into VWRL or some such passive diversified vehicle I plumped for a physical gold ETC.

I used to laugh but now I’m the same

Take a look at a brand new gold bug– Elvis

There may be or may not be more tin foil in my house than my oven usage (about once a month, mainly to warm up pizza) justifies, however, this particular purchase was not an impulse decision. I’d been contemplating it for a while, and because of my thumbsucking I may have missed a good buying opportunity in December last year, but hell, I’d rather pay the tax on the cautious than the tax on the stupid.

My thinking was as follows:

- I’m running out of carry forward pension allowance, which will make rebalancing with new money difficulter and difficulter in the future.

- I don’t particularly like current equity valuations.

- I believe what this guy says about asset class diversification and safe withdrawal rates.

- I don’t want to sit on cash for fear of inflation, and I particularly don’t want to sit on GBP cash because of the reasons I touched on in a series of angry ejaculations that can be loosely described as my previous blog posts about Brexit.

In general investing in gold is understood to be a vote of no confidence against the US economy.

The long term price of gold negatively correlates with USD and has virtually no correlation with share prices (I think it’s something like +0.1), because when USD is cheap the US stock market tends to rally, like the FTSE rallied on cheap GBP, therefore a weak dollar can push up both gold and share prices. In a long data series analysis this effect offsets the short term emotional swings, when gold is treated as a safe haven investment in times of stock market panic.

This makes gold a good portfolio diversifier. It does, however, have certain quirks, some more desirable than others.

Gold often trades on emotion

In the short term gold price can depend more on how investors feel about other asset classes rather than on how they feel about the yellow shiny itself. This both exacerbates the price volatility and makes it difficult to come up with a medium term base-line price. The question is, does this matter?

If I’m going to be using gold as a temporary storage facility until such time as I like equity valuations better than I do now, this is emotion-driven pricing is actually a plus. Since I’m not a USD investor, currency movements will cause certain complications. 100% of gold is denominated in USD, but only about 50% of VWRL is; this may limit my gains from exchanging my gold for shares in a stock market dip scenario.

The price of gold is volatile, even for a commodity

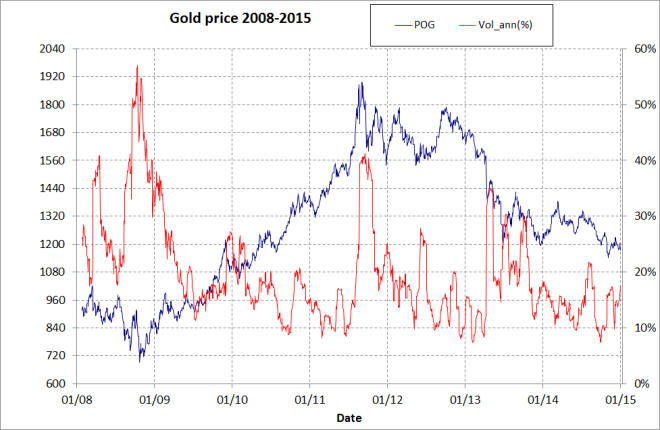

Between 1973 and 2015 the standard deviation of day to day gold price movements was 1.33%; this is equivalent to an annualized volatility of 21.11%. The below graph shows the gold price (USD/Oz) (the blue line on the left axis) and the volatility of the gold price (the red graph on the right axis).

A 20% annualised swing is a non event.

Source: Mining Corner

The involvement of central banks in the gold market exacerbates its volatility. Since 2010 central banks have generally been net purchasers of gold.

A lot of the new demand is coming from the emerging markets who wish to diversify away from USD denominated holdings. Gold is one of the few assets universally permitted by the investment guidelines of the world’s central banks, and even though the market is deep and liquid, a large transactions by someone like China can move the market.

Inflation

In the long term though, gold roughly tracks inflation, and the cost of extraction is a pretty good gauge of what is a good deal, and how much is too much.

Tin foil or not, I find it hard to ignore trillions close to zero yielding government debt and the ways in which their issuers, who also happen to be in control of fiat currencies in which the debt is denominated, may want to discharge of their obligations.

The price is right

The break even price of extraction is about $1,000 per ounce, give or take. Because of their largely fixed cost base, gold miners can easily weather the sub $1,000 price for a few years[1]. However, there wouldn’t be a lot of exploring going on then, and old mines eventually run out. The c. $1,233 which I bought it at was not a bargain, but it was not a ripoff either.

Expensive US dollar

As much as I believe in the American exceptionalism, the dollar’s current valuation does not pass the balance of probabilities. I think America is great, but not that great. Even if the country weren’t run by a thin-skinned Putin aficionado, not so much short of scruples as totally devoid of them, who’s trying to stage a party for the 1% at the expense of the middle class[2], there’d still be a question of how much more the American middle class can borrow on top of what they already owe.

The way I see it, the Fed’s upcoming rate hikes notwithstanding, there’s more potential downside to the USD than upside. But even if I’m wrong, macrodemographics are on my side.

Chindia

Some societies use gold as a store of wealth more than others; it is Known (see: China and India). It happens that presently those that do are growing faster than most of the others. India is also set to become the worlds most populous country for a while, before Nigeria overtakes it. I’m guessing this should support the demand for gold.

Of course, in the end it will all turn out the way it turns out 😉

Notes:

- Cash cost of production in US$/oz is between $350 and $400.

- Because: robbing the poor is not as profitable as it’s made out to be.

I’ve been holding the most gold I’ve ever held in my life for about six months, for very similar reasons. Will probably add more, but even after will still only be talking low single digits percentage wise. My reasoning is pretty similar to yours. With the pound down here I think it’s worth considering hedged as well as unhedged gold (if you’re happy with ETF exposure for some of your hoard) if you’ve not done so already. Just a thought, your mileage may differ.

LikeLike

This is a very interesting comment.

I hadn’t looked into hedged gold ETFs at all, to be honest.

I’m absolutely fine with currency hedging as such, I think credit risk even for OTC currency derivatives is insignificant (or at least not any greater than the general risk inherent in the financial system), the spreads are not that large, the cost of the fund putting up collateral (if any) is minuscule, etc… I simply hadn’t considered the case for holding hedged ETFs in my portfolio as opposed to / as well as non-hedged ETFs.

Thinking about it now, it could be a good idea to have exposure to both hedged and non-hedged gold. Perhaps hedging would take care of the GBP movements caused by “domestic” factors, to the extent that weak sterling strong dollar since both could devalue at the same time vs the rest of the world because of different reasons.

If you’re in a position to share, I’d be interested to hear what purpose hedged gold ETFs serve in your portfolio that non-hedged ones can’t. Is it merely a speculative position on sterling appreciating with some protection against inflation in the interim, or do you have a specific scenario in mind where the hedged vehicle will serve as the proverbial bullet? Why didn’t you choose to just ride the currency risk?

LikeLike

What ETF/Fund are you using for Hedged Gold. Looking into this as well at the moment. And surely over the medium term (2-5 years) the pound will rise again against the dollar\Euro.

LikeLike

Not sure about the sterling rising over the medium term, but I’ve been looking into it since yesterday ;). Here’s a couple of physical hedged gold ETCs I’ve found.

https://www.trustnet.com/Factsheets/Factsheet.aspx?fundCode=J5FVW&univ=E

http://funds.ft.com/uk/Tearsheet/Summary?s=XGLS:LSE:GBX

ETFS seems a lot cheaper than Deutsche…

LikeLike

Charting these against ISHARES PHYSICAL GOLD ETC GBP or iShares Physical Gold ETC GBP I don’t see any currency benefits of the hedging. I must be missing something? Is the hedging not giving any stability against currency movements?

LikeLike

That’s strange, I get quite a bit of difference – have a look at this:

Here’s how I got this:

– go to http://www.londonstockexchange.com/exchange/prices-and-markets/ETPs/company-summary-chart.html?fourWayKey=JE00B7VG2M16JEGBXETCS

– select “compare security” (click on any letter then type in SGLN in the search box) and press search.

You can see the difference even intra-day, but obviously it’s most apparent over a long period where there has been a large currency swing. If you chart that against the Deutsche vehicle XGLS there’s very little difference:

LikeLike

Yes my mistake, not sure what I ended up graphing to come to my conclusion (must have been $ against $). I think I may end up splitting my ‘precious’ hedged and none as this will be my first foray into hedging. Thanks for the post.

LikeLike